Nigeria’s real estate market is experiencing growth, and it’s far beyond a passing trend. With rapid urbanisation sweeping across the nation and a critical nationwide housing deficit estimated at over 20 million units, real estate has emerged as one of the most profitable and reliable investment vehicles in Nigeria today.

The beauty of real estate investment in Nigeria lies in its diversity and accessibility. Whether you’re a young professional taking your first steps into the investment world, a Nigerian living in the diaspora looking to build wealth back home, or a seasoned property flipper with years of experience, the Nigerian real estate market offers opportunities that can be tailored to virtually any budget, risk tolerance, and investment timeline.

However, success in real estate isn’t just about buying any property and hoping for the best. The most successful investors understand that different types of real estate investments serve various purposes and offer varying levels of return on investment.

In this comprehensive guide, we’ll explore the seven most profitable real estate investment types available in Nigeria throughout 2025.

Also, we’ll provide detailed analysis, real-world examples, accurate cost breakdowns, and expert insights to help you make informed decisions that align with your financial goals and investment strategy.

Why Real Estate in Nigeria Remains a Smart Investment Choice

Before diving into specific investment types, it’s crucial to understand the fundamental factors that continue to make Nigerian real estate an attractive investment proposition across multiple economic cycles.

Population Growth and Demographics: Nigeria’s population continues to grow at a rapid rate, with projections indicating that the country will reach 230 million people by 2030. This demographic boom creates sustained demand for housing across all segments, from affordable housing for young families to luxury properties for high-net-worth individuals. The growing population also drives demand for commercial spaces, retail outlets, and office buildings, creating opportunities across the entire real estate spectrum.

Urban Migration and City Expansion: Major Nigerian cities, including Lagos, Abuja, Port Harcourt, Uyo, and Ibadan, are experiencing rapid expansion as people migrate from rural areas seeking better economic opportunities.

This urban migration pattern creates increasing demand for residential properties in city centres and suburbs, while also driving infrastructure development that benefits property values in surrounding areas.

Inflation Hedge and Currency Protection: In an economy where the naira faces periodic devaluation pressures, real estate serves as a crucial hedge against inflation. While cash savings lose purchasing power over time, well-located properties typically appreciate, protecting and growing wealth in real terms. This characteristic makes real estate particularly attractive for long-term wealth preservation and growth.

Multiple Income Streams: Unlike many other investment types, real estate offers multiple ways to generate returns. Investors can earn rental income for steady cash flow, benefit from property appreciation over time, and even generate additional income through property management services or real estate development activities.

Accessibility Across Income Levels: Contrary to popular belief, you don’t need to be a millionaire to start investing in Nigerian real estate. With options ranging from cheap land investment in Nigeria’s emerging areas for under one million naira to Real Estate Investment Trusts (REITs) that allow investment with as little as ten thousand naira, there are entry points for virtually every budget level.

7 Profitable Real Estate Investment Types in Nigeria Today

1. Land Flipping: The Foundation of Real Estate Wealth

Land flipping is a profitable property investment in Nigeria. It also represents the most accessible and beginner-friendly entry point into Nigerian real estate investment.

The strategy involves identifying undervalued land in areas poised for development, purchasing at current market rates, and holding the property until appreciation makes resale profitable.

The Strategy Explained: Successful land flipping requires careful research and timing. Investors typically target areas on the outskirts of major cities where government infrastructure projects, private developments, or natural expansion patterns will drive future demand.

Popular areas include Epe and its environs in Lagos State, the rapidly developing Alaro City corridor, and the expanding suburbs of Enugu, Ibadan, and Port Harcourt.

ROI Potential and Real Examples: The return potential for land flipping can be extraordinary, with successful investments yielding 80% to 250% returns in high-growth areas with confirmed infrastructure development. A concrete example illustrates this potential: plots of land in Epe that sold for 600,000 naira in 2021 are now commanding prices of 2.5 million naira and higher, representing over 300% appreciation in just four years.

Risk Management: Success in land flipping requires careful due diligence. Investors must verify land ownership through proper documentation, ensure the area has realistic development potential, and avoid speculative purchases in areas without concrete development plans. Working with reputable real estate agents and legal professionals is essential for protecting investments and ensuring proper title transfer.

Related: Top 6 Locations You Can Get Cheap and Affordable Lands in Lagos

2. Buy-to-Rent Residential Properties: Building Steady Income Streams

The buy-to-rent strategy involves purchasing residential properties specifically for rental income, providing investors with regular cash flow while building long-term wealth through property appreciation.

Prime Location Analysis: The most profitable buy-to-rent opportunities are typically found in areas with strong rental demand from working professionals, families, and students. In Lagos, areas like Yaba, Surulere, and Egbeda on the mainland offer excellent rental yields due to their proximity to business districts and relatively affordable living costs.

In Abuja, suburbs such as Lugbe, Gwarinpa, and Kubwa attract steady tenant demand from government workers and private sector employees.

Income Projections and Market Analysis: A well-positioned two-bedroom apartment in Yaba can generate annual rental income of 2.5 to 3 million naira, while a duplex in Lugbe typically commands around 3.5 million naira per year. These figures represent annual returns of 8% to 15% on investment, not including the additional benefit of property value appreciation over time.

Value Addition Strategies: Experienced investors often focus on older buildings in high-demand areas that can be renovated and upgraded to command premium rents. This approach allows investors to purchase properties below market value, add value through strategic improvements, and achieve higher rental yields than newly constructed properties.

3. Short-Let Apartments: Capitalising on the Airbnb Revolution

The short-let apartment model has revolutionised the hospitality sector in Nigeria, offering investors the opportunity to earn significantly higher returns than traditional long-term rentals by catering to business travellers, tourists, and temporary residents.

Market Dynamics and Location Strategy: The success of short-term rentals depends heavily on the selection of location and property positioning. The most profitable short-let properties are typically found in areas with high concentrations of business activity, tourist attractions, or limited hotel availability. In Lagos, locations like Lekki Phase 1 and Victoria Island are short-let hotspots, and they command premium rates due to their proximity to major business centres and upscale amenities.

Revenue Potential and Operational Considerations: Well-positioned short-let apartments can generate between 50,000 and 150,000 naira per night, depending on location, quality of furnishing, and market positioning. Properties that maintain consistent occupancy rates can earn over one million naira per month, although this requires significant investment in premium furnishings, professional property management, and ongoing maintenance.

Success Factors: The short-let market is highly competitive and requires active management, professional marketing, and consistent quality standards. Successful short-let operators invest heavily in property presentation, guest experience, and online reputation management to maintain high occupancy rates and premium pricing.

4. Off-Plan Property Investment: Timing the Development Cycle

Off-plan investment involves purchasing properties during the construction phase at pre-completion prices, to resell upon completion when market values have increased.

Investment Mechanics: This strategy typically involves making staged payments during construction, with the final payment due upon completion. Investors can often secure properties at 20-30% below the completed market value, then sell upon completion for significant profits. For example, a property purchased for 70 million naira during construction might sell for 90-100 million naira upon completion.

Developer Selection and Risk Management: Success in off-plan investment depends heavily on choosing reputable developers with proven track records. Established developers like Hontar, Novarick, HomeWork, and Urban Shelter have demonstrated consistent delivery capabilities.

At Thinkmint Nigeria, we partner with these trusted developers, and since 2021, we have completed and delivered more than 30 off-plan properties to happy investors. You can key into our current off-plan project by visiting www.thinkmint.ng/buyrealestate for more information, call 0809 784 5065

Documentation and Legal Protection: Off-plan investments require careful attention to legal documentation, including allocation letters, payment receipts, and detailed construction schedules. Working with experienced real estate lawyers helps protect investor interests and ensures proper title transfer upon completion.

5. Commercial Real Estate: Scaling for Serious Returns

Commercial real estate investment involves purchasing properties specifically for business use, including retail spaces, office buildings, warehouses, and mixed-use developments. While requiring higher initial capital, commercial properties typically offer superior returns and longer-term lease agreements.

Market Segments and Opportunities: Commercial real estate encompasses various property types, each with distinct risk and return profiles. Shopping complex units in established commercial areas like Trade Fair in Lagos offer steady rental income from retail tenants. Warehouses near major ports such as Apapa and Tincan serve the logistics industry and command premium rents due to limited supply and high demand.

Return Analysis: Commercial properties typically generate annual returns of 15% to 25% through lease agreements, significantly higher than residential rentals. Additionally, commercial properties often have lower vacancy rates when properly positioned, as businesses typically sign longer-term leases and are less likely to relocate frequently.

Investment Considerations: Commercial real estate requires an understanding of business cycles, tenant industries, and local economic factors. Properties may require higher maintenance investments and are subject to various government regulations. However, for investors with sufficient capital and risk tolerance, commercial real estate offers some of the highest returns in the property market.

Read Also: Commercial Real Estate Opportunities in Nigeria’s Growing Tech Hubs

6. Property Flipping: Turning Real Estate into Quick Profits

In Nigeria’s rapidly evolving property market, property flipping has emerged as one of the fastest ways to generate substantial profits (if done right!)

At its core, property flipping involves purchasing real estate at a lower price, making value-adding improvements, and reselling it at a significantly higher price within a short time frame, often between 6 to 18 months.

The appeal is clear: instead of waiting years for appreciation, savvy investors can create instant equity by strategically upgrading and marketing a property. This approach works exceptionally well in urban centres like Lagos, Abuja, and Port Harcourt, where demand for modern, move-in-ready homes is high.

How to Succeed with Property Flipping in Nigeria

- Identify Undervalued Properties

Look for distressed or outdated properties in good locations—areas with high rental demand, ongoing infrastructure development, or commercial expansion.

- Renovate with ROI in Mind

Focus on improvements that directly boost resale value—such as modern kitchens, upgraded bathrooms, fresh painting, new flooring, and enhanced security.

- Time Your Sale Strategically

Sell during peak demand seasons (often after festive periods or during relocation cycles) to attract competitive offers.

- Leverage Professional Marketing

High-quality photography, staging, and online promotion can significantly increase buyer interest and perceived value. For more information on how to do property flipping, read this post here

7. REITs and Property Funds: Passive Real Estate Investment

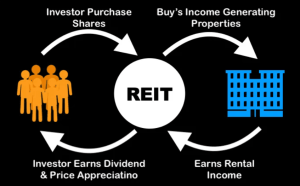

Real Estate Investment Trusts and property funds offer investors the opportunity to participate in real estate markets without direct property ownership, management responsibilities, or large capital requirements.

How REITs Function: REITs are investment vehicles listed on the Nigerian Stock Exchange that pool investor funds to purchase, lease, and manage income-producing real estate. Investors receive dividends from rental income and property appreciation, providing exposure to diversified real estate portfolios with professional management.

Accessibility and Benefits: REITs offer entry points as low as 10,000 to 100,000 naira, making real estate investment accessible to small investors. The investment is regulated by the Securities and Exchange Commission, providing investor protection and transparency. Additionally, REIT shares can typically be bought and sold more easily than direct property ownership.

Limitations and Considerations: While REITs offer convenience and accessibility, they provide less control over investment decisions and may offer lower returns than direct property investment. They are best suited for investors seeking passive income and portfolio diversification rather than maximum returns.

Investment Comparison and Selection Guide

Budget-Based Selection: Investment choice should align with available capital and risk tolerance. Land flipping offers the lowest entry point (500,000 to 5 million naira) with high return potential, making it ideal for beginners. Buy-to-rent requires moderate capital (10-40 million naira) but offers steady income. Commercial properties require significant capital (20 million naira and above) but provide the highest returns for experienced investors.

Risk and Return Analysis: Higher returns typically come with increased risk and management requirements. Short-let apartments offer very high returns but require active management and market knowledge. REITs offer lower but more predictable returns with minimal management requirements.

Time Horizon Considerations: Some strategies, like land flipping, are designed for medium-term holding periods (1-3 years), while buy-to-rent and commercial properties are typically long-term investments (5+ years) that build wealth through both income and appreciation.

Conclusion: Building Wealth Through Strategic Real Estate Investment

Real estate continues to represent one of the most reliable and profitable wealth-building strategies available in Nigeria today. The key to success lies in matching investment strategies to individual circumstances, conducting thorough market research, and maintaining realistic expectations about risks and returns.

Successful real estate investment in 2025 requires focusing on location selection based on infrastructure development and demographic trends, understanding your personal risk tolerance and investment timeline, working exclusively with verified agents and developers who can provide proper documentation, and maintaining patience while allowing market forces and time to build wealth.

Whether you’re starting with land investment, scaling up to commercial properties, or keeping things simple with REITs, there’s a real estate investment strategy that can fit your budget and help you achieve your financial goals. The most important step is getting started with proper research and professional guidance.

Frequently Asked Questions

What is the most profitable real estate investment in Nigeria? Land flipping and short-let apartments currently offer the highest ROI potential, though profitability depends heavily on location selection, timing, and market conditions.

Can I invest in real estate with limited capital in Nigeria? Absolutely. Start with land purchases in emerging areas, REIT investments, or joint investment platforms that allow smaller initial investments while building toward larger opportunities.

Are off-plan projects safe investments in Nigeria? Off-plan projects can be profitable but require careful due diligence. Only invest with verified developers who have proven track records, and always use real estate lawyers to review all documentation before committing funds.

Is real estate better than traditional savings in Nigeria? In most economic conditions, yes. Real estate typically appreciates over time and provides inflation protection, while traditional savings accounts often fail to keep pace with inflation, resulting in decreased purchasing power over time.