Secondary Cities Rising: Investment Hotspots Beyond Lagos & Abuja

In the Nigerian real estate world, two cities—Lagos and Abuja —have long dominated the spotlight. Their rapid development, infrastructure, and high return potential made them an ideal choice for most investors. But as these markets become increasingly saturated and expensive, a quiet revolution is coming on.

Secondary cities across Nigeria are on the rise, offering smart investors more affordable entry points, faster growth potential, and untapped opportunities. If you’re looking to diversify your portfolio or enter the market at the ground floor, these emerging cities may be exactly where your attention should shift next.

Why These Secondary Cities Are Gaining Investor Attention

The appeal of secondary cities goes beyond affordability. A mix of economic and social shifts is pushing both Nigerians and investors to consider cities beyond the traditional hubs.

Here’s why:

- Skyrocketing costs in Lagos & Abuja: The cost of land, construction, and living has priced out many middle-class investors and developers.

- Decentralization & government push: Federal and state governments are actively investing in infrastructure outside Lagos and Abuja to promote regional development.

- Improved infrastructure: Roads, power, and broadband connectivity are steadily improving in once-ignored cities, making them viable options for work and living.

- Urban migration trends: Nigerians are increasingly relocating to cities with lower living costs, less congestion, and new economic opportunities.

5 Emerging Investment Hotspots Beyond Lagos & Abuja

1. Ibadan – Affordable Growth in the Southwest

As Nigeria’s largest city by landmass, Ibadan is undergoing a quiet boom. It sits just 90 minutes from Lagos via the Lagos-Ibadan Expressway and the modern rail system, making it a top relocation choice for those priced out of Lagos.

Why invest:

- Residential estates are springing up in areas like Akobo, Oluyole, and Moniya

- Tech hubs and SMEs are gaining traction

- Property prices are still 50–70% lower than those of Lagos

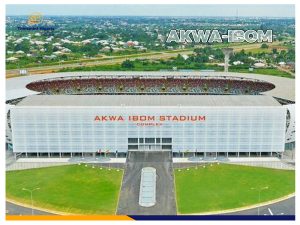

2. Uyo – Clean, Peaceful, and Investment-Ready

Uyo, the capital of Akwa Ibom State, is arguably one of Nigeria’s best-planned cities. Known for its cleanliness, hospitality, and fast-improving infrastructure, it’s fast becoming a tourism and residential hotspot.

Why invest:

- State government support for tourism and hospitality

- Ongoing investments in road networks and stadiums

- Rising demand for residential housing and shortlets

3. Enugu – Eastern Nigeria’s Tech & Talent Hub

Enugu is reclaiming its role as a business and tech hub in Southeastern Nigeria. With its top universities, vibrant youth population, and growing middle class, the city is attracting real estate developers and tech entrepreneurs alike.

Why invest:

- Surging rental demand from students and young professionals

- Tech incubators and creative spaces on the rise

- Strategic road connections to Anambra and Abia States

4. Port Harcourt – Oil Economy Meets Urban Living

Despite its oil-heavy economy, Port Harcourt is diversifying. Residential and commercial property developments are booming in areas like GRA Phase 3, Peter Odili Road, and Ada George. With the return of peace and security improvements, the city is back on investors’ radar.

Why invest:

- High rental yields in residential real estate

- Oil & gas firms driving consistent demand for housing

- Strong purchasing power of residents and businesses

5. Asaba – Creativity, Tourism, and Rising Demand

Asaba, the Delta State capital, is emerging as a creative and lifestyle hub. With its proximity to Onitsha and growing Nollywood presence, it’s attracting tourists, filmmakers, and digital entrepreneurs.

Why invest:

- Growth in boutique hotels, guest houses, and shortlet apartments

- The presence of film studios and festivals boosts hospitality

- Rising land prices in areas like Okpanam and Summit Road

What Type of Investments Are Thriving in These Cities?

Each city has unique strengths, but the following sectors show the most promise across the board:

Mid-income residential housing: Demand is growing as more people migrate from expensive metro areas.

Shortlets and hospitality: Tourists, remote workers, and professionals seek flexible accommodations.

Commercial real estate: Shopping complexes, co-working spaces, and offices are on the rise.

Agro-processing and tech hubs: Secondary cities offer cheaper land for setting up industrial or digital clusters.

How to Identify a Profitable Secondary City

Before jumping in, you need to ensure your investment is smart and sustainable. Here’s how to identify where to put your money:

Look for infrastructure projects: Road construction, airport upgrades, or government-backed tech hubs are signs of a city on the rise.

Follow migration trends: Where people move, demand for housing and services follow.

Check rental data: Rising rent prices without excessive vacancies indicate healthy growth.

Work with local experts: Partner with trusted agents and developers to understand the nuances of each city.

Expert Tips for Successful Investment

\

Buy early in developing neighborhoods: Prices are lowest before the crowd arrives.

Diversify your asset mix: Combine land banking with rental income opportunities.

Think long-term: Real growth in secondary cities often comes over 3–5 years.

Leverage incentives: Some state governments offer tax breaks or land subsidies for investors.

Conclusion: The Smart Investor Moves First

Lagos and Abuja will always have their place. But the future of Nigeria’s real estate and business growth is decentralized. Secondary cities like Ibadan, Uyo, Enugu, Port Harcourt, and Asaba offer high ROI potential at a fraction of the cost.

If you want to stay ahead of the curve—and avoid the crowd—now is the time to start exploring these emerging hotspots.

Ready to explore property deals in Nigeria’s rising cities?

Reach out to our expert team for insights, city-specific data, and exclusive opportunities. Check out www. thinkmint.ng/buyrealestate find affordable properties with flexible payment plans across Nigeria’s emerging cities.

FAQs

Q: What are the best cities to invest in Nigeria beyond Lagos?

A: Ibadan, Uyo, Enugu, Port Harcourt, and Asaba are strong contenders based on growth, infrastructure, and ROI potential.

Q: Why are people moving to cities like Uyo and Enugu?

A: Lower living costs, better infrastructure, and improved security.

Q: Is it safe to invest in secondary Nigerian cities?

A: Yes, especially if you work with verified agents, conduct due diligence, and invest in cities with strong government backing.