Lagos Business School (LBS) and the Nigerian Institution of Estate Surveyors and Valuers (NIESV) convened the inaugural edition of the LBS-NIESV Real Estate Industry Summit 2023 on the 29th of November 2023 at the Honeywell Auditorium, Lagos Business School, Lekki-Epe Expressway.

Nigeria’s real estate industry can potentially drive economic advancement, contributing significantly to the economy. However, the real estate industry must be positioned to take advantage of the opportunities to drive this growth.

To tackle these issues, Lagos Business School (LBS) together with the Nigerian Institution of Estate Surveyors and Valuers (NIESV) convened the inaugural edition of the LBS-NIESV Real Estate Industry Summit 2023.

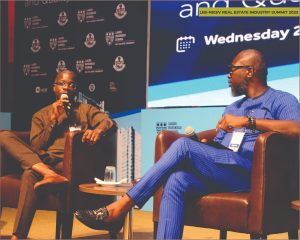

The LBS-NIESV Real Estate Industry Summit is a gathering of industry thought leaders, key policy and decision makers and other stakeholders within the industry. The summit sought to drive discourse that will shape and transform the future of Nigeria’s real estate industry.

This one-day event featured three panel discussions around these key themes:

– Real estate finance strategies

– Strategic investment approaches

– Harnessing emerging technologies

KEYNOTE ADDRESS

Udo Okonjo CEO – Vice Chairman

Fine and Country West Africa

Gbenga Olaniyan – Chairman

Estatelinks Ltd

PANEL SESSION I

PANEL SESSION I

Real Estate Finance Strategies

Tola Akinhanmi – Head of Real Estate Finance,Stanbic IBTC

Mortgage can be applied by obtaining a loan from a bank or financial institution to purchase a property. The borrower makes regular mortgage payments over a specified period of time.

Gbenga Ismail – Ismail & Partners

Rent-to-Own strategy allows tenants to rent a property with the option to purchase it in the future. A portion of the rent payments goes towards building equity, which can be used as a down payment when buying the property.

Grace Ofure – Founder Lifecard University

Investors can partner with others to pool resources and invest in real estate projects. This strategy allows for shared risks and rewards, as well as access to a larger pool of capital.

Andrea Goday – El Alan Construction

REITs is another financial strategic investment vehicle that allows for individuals to invest in a diversified portfolio of real estate assets. Investors can buy shares in a REIT, which provides them with regular dividends and the potential for capital appreciation.

These strategies can vary in terms of risk, return on investment, and eligibility requirements. It’s important to do thorough research and seek advice from professionals before deciding on a finance strategy for real estate investment in Nigeria.

PANEL SESSION II

PANEL SESSION II

Real Estate Investment Approaches

Prince Adeniyi Aromolayan – Executive Director LSDPC

Mixed-use developments, which combine residential, commercial, and retail spaces, are gaining popularity in Nigeria. These developments offer diversification and can attract a wide range of tenants and buyers, increasing the potential for rental income and capital growth.

Chukwudi Ubosi – Ubosi Eleh & Co

Investing in properties that can generate rental income is a popular strategy. Consider properties that are in high demand for rentals, such as residential apartments or commercial spaces in busy areas. This can provide a steady stream of income and potential capital appreciation over time.

Ashish Khemka – CFO Free Trade Zone

Investing in off-plan properties can be a strategic move. Off-plan properties are those that are still under construction or development. By purchasing at an early stage, you may benefit from lower prices and potential value appreciation when the project is completed.

Prof. Ayo Omotayo – DG. Nigeria Institute for Policy & Strategic Studies

Choosing the right location is crucial for a successful real estate investment. Look for areas with high growth potential, such as developing neighborhoods, proximity to amenities, and good infrastructure. Areas like Lekki, Victoria Island, and Ikeja are known for their real estate growth in Lagos.

In conclusion, it’s essential to conduct thorough research, consult with professionals, and assess your risk tolerance before making any investment decisions. The real estate market in Nigeria can be dynamic, so staying informed and adaptable is key.

PANEL SESSION III

PANEL SESSION III

Real Estate Emerging Technologies

Jide Odusolu – MD Octo5 Holdings

Real estate websites and mobile apps have become popular platforms for property listings, allowing users to search for properties based on their preferences, view images, and even take virtual tours. These portals make it easier to find and compare properties, saving time and effort.

Dr. Fayomi Igho – HOD Lead City University

Smart home devices and automation systems are becoming more prevalent in the real estate market. These technologies allow homeowners to control various aspects of their properties remotely, such as lighting, security systems, temperature, and even appliances. Smart homes are seen as more desirable and can increase property value.

Chude Osiegbu – CEO Venco

Data analytics is being used to gather insights and make informed decisions in the real estate market. By analyzing market trends, pricing data, and customer preferences, real estate professionals can better understand the market dynamics and make strategic investment decisions.

These emerging technologies are transforming the real estate landscape in Nigeria, making it more accessible, efficient, and innovative. It’s an exciting time for the industry!