The nation moved from 6th to 3rd in 2019 on Absa’s Financial Markets 2020 Index. One commonality across all funding reports is the rise and domination of Nigeria as an investment destination. Nigeria is the leading destination for startup venture capital investment on the continent. But the currency remains a sore point and maneuverings by the CBN, while well-meaning has done little to stem it.

Police brutality against Nigeria’s young demographic vaulted the country to the international stage as the government sought to recover from poorly handling peaceful protests. This brought to the fore recurring issues in government transparency. The youth would return to making the most of the Nigerian economy, contributing to much of the businesses online. Transactions value increased from $77Bn in Q2 to $116Bn in Q3 2020.

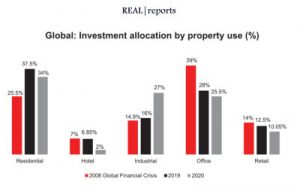

Big brand hospitality chains saw bookings drop by over 94% and are unlikely to see pre-COVID levels until

Q3 2021 at the earliest. There has been no demand for student housing, a result of the universities’ strike over funding agreements with the central government. It is hoped that the armistice between the regulators and

the lecturers will be more permanent than in previous seasons. Central business districts are no longer the

undisputed destination for new developments. Some suburbs are now under strong consideration as developers are choosing, as they did in the 2018 recession, to make more research-driven decisions.Both retail and office landlords are changing to remain attractive. Real estate investment managers are embracing technology more intently to accurately forecast performance metrics.